Health insurance in the UAE is more than just a regulatory requirement—it serves as a foundational pillar of the country’s commitment to delivering high-quality, accessible healthcare for everyone. The healthcare ecosystem is actively managed by regional authorities such as the Dubai Health Authority (DHA) and the Health Authority Abu Dhabi (HAAD), which regulate services, enforce mandatory coverage, and champion health equity across diverse communities.

Under legal mandates like the ISAHD framework in Dubai, every resident—Emirati or expatriate—is required to maintain health insurance. This requirement is efficiently executed through a government-managed digital infrastructure that links insurance coverage directly to each individual’s Emirates ID, simplifying access to healthcare and eliminating the need for physical cards.

Government-backed programs like Thiqa provide comprehensive plans for Emirati nationals, while Basic Health Plans and employer-sponsored insurance options ensure inclusive protection for the wider resident population. This unified approach reflects the UAE’s broader strategy to promote a healthier society, reduce long-term healthcare costs, and strengthen public trust in national health systems.

In the UAE, health insurance is not only a legal duty—it’s a vital component of everyday life and a reflection of civic responsibility.

In this blog, we will explore the structure, requirements, and benefits of the UAE’s health insurance system and how it supports the vision of universal health coverage.

Top Health Insurance Providers in the UAE (2025)

Below is a curated comparison of trusted health insurance companies operating in the UAE, based on coverage types, digital tools, regulatory alignment, and customer reputation.

| Insurance Provider | Type | Starting From (AED) | Specialties & Strengths | Regulatory Affiliation | Best For |

|---|---|---|---|---|---|

| Daman | Semi-government | 650 – 3,000+ | Thiqa, enhanced networks, Emirates ID integration | DoH, UAE Central Bank | UAE Nationals, Expats in Abu Dhabi |

| AXA (GIG Gulf) | International | 2,500 – 12,000 | Global access, corporate plans, digital services | DHA, DoH | Expats, corporates, global coverage |

| Salama | Takaful (Islamic) | 900 – 2,000 | Shariah-compliant, ethical plans, mobile portal | UAE Central Bank | Muslim residents, ethical coverage seekers |

| Orient Insurance | Private | 700 – 1,500 | Corporate group plans, affordability | DHA | Employer-sponsored plans in Dubai |

| MetLife | Private (Global) | 3,000 – 10,000 | Flexible family plans, international options | DHA, DoH | Families, professionals |

| Noor Takaful | Takaful (Islamic) | 850 – 2,500 | Digital-first, Islamic-compliant, telehealth | UAE Central Bank, MOHAP | Freelancers, Shariah-seeking expats |

| Emirates Insurance Co. | Government-linked | 1,200 – 3,500 | Affordable plans, local support in Abu Dhabi | DoH | Small families, local residents |

| Oman Insurance | Private | 1,200 – 5,000 | Expats, mobile tools, enhanced plans | DHA | Long-term expats, digital-first users |

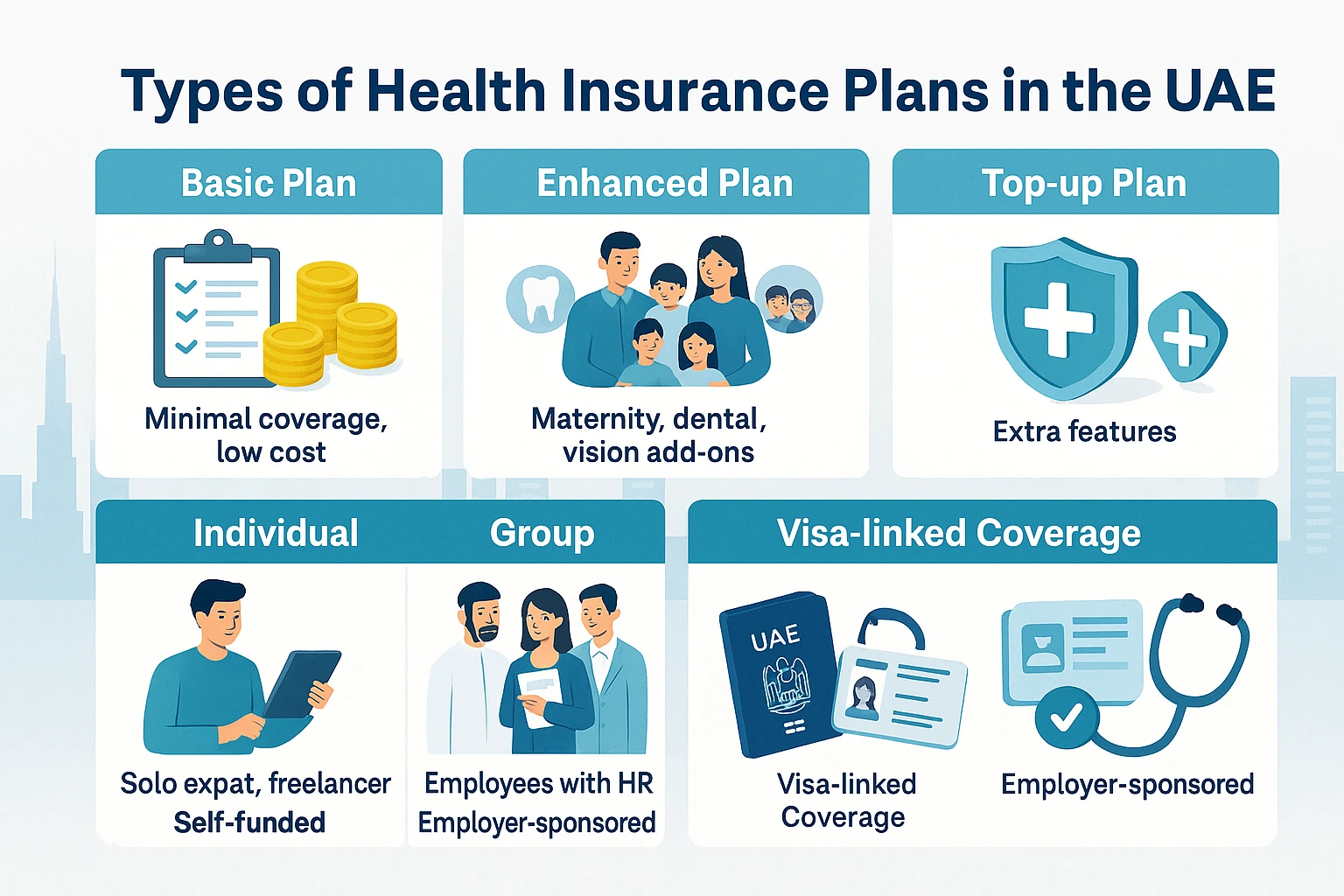

Types of Health Insurance Plans in the UAE

Understanding health insurance schemes in the UAE is crucial. Residents and expatriates seek regulatory-compliant, affordable, and comprehensive medical coverage.

Health insurance options range from basic-tier policies to enhanced-tier plans. Basic-tier policies provide the minimum mandated benefits, particularly for visa-related compliance. Enhanced-tier plans encompass broader healthcare services. These include maternity care, dental treatment, and international medical support.

This differentiation is important when comparing individual policies for freelancers, dependents, or domestic workers with employer-sponsored group plans. Group plans often leverage risk pooling to provide broader coverage.

All UAE residents are legally obligated to hold active health insurance linked to their visa status.

This section categorizes available plan types. The goal is to facilitate decision-making based on your residency classification, medical needs, and financial situation.

Basic vs Enhanced Plans

Health insurance in the UAE is structured into three primary tiers—Basic, Enhanced, and Top-up—each offering varying degrees of coverage, legal obligations, and benefits. Regulated by the Dubai Health Authority (DHA), these plans cater to different population segments, from low-income workers to professionals and families. Basic plans fulfill mandatory DHA requirements with limited benefits, while Enhanced plans offer broader coverage through employers or private insurers. Top-up plans serve as add-ons, filling gaps in maternity, dental, chronic care, and other specialized needs. Understanding these tiers helps residents and expatriates select coverage that aligns with both DHA compliance and their specific healthcare priorities.

| Feature | Basic Plan | Enhanced Plan | Top-up Plan |

|---|---|---|---|

| Coverage Type | Essential medical services only | Comprehensive (maternity, dental, vision, etc.) | Adds extra benefits to Basic or Enhanced plans |

| Legally Mandated? | Yes – for low-income and visa-linked residents | No – employer-sponsored or voluntary | No – fully optional |

| Who Offers It | DHA-regulated providers | Private insurers, employers | Same or third-party insurers |

| Ideal For | Domestic workers, low-income residents | Professionals, families, expats | Individuals needing added protection |

| Maternity Coverage | Limited, subject to waiting period | Full benefits, often with fewer restrictions | Extended maternity coverage if needed |

| Waiting Periods | Common (6–12 months for maternity) | Shorter or waived depending on insurer | Applies to specific added benefits |

For instance, a domestic worker in Abu Dhabi is required to have a Basic Plan as per HAAD’s regulation. But a freelance designer may voluntarily opt for an Enhanced Plan that includes dental and vision coverage. If traveling often, a Top-up Plan can provide emergency medical coverage abroad.

Individual vs Group Insurance

Understanding the difference between individual and group health insurance is essential for residents and expatriates navigating the UAE’s mandatory healthcare system. Individual health insurance refers to self-funded plans purchased directly by a person—often freelancers, investors, or dependents not covered by an employer. These policies offer flexibility in selecting benefit tiers, network providers, and premium levels based on personal healthcare needs and budget.

In contrast, group health insurance is employer-sponsored and provided as part of a worker’s compensation package. These plans are typically standardized by job level and may extend limited coverage to spouses and children, depending on the employer’s policy. In Dubai, independent professionals must secure individual coverage to maintain visa compliance. In Abu Dhabi, salaried employees are usually enrolled in group insurance through their company.

For families, it’s critical to confirm whether dependents are included in an employer’s plan. If not, separate individual policies must be arranged. UAE labor law mandates that employers provide insurance for all employees, making group coverage a legal requirement—not just an added benefit. Non-compliance can result in fines, reinforcing the importance of understanding your insurance obligations and options.

| Feature | Individual Insurance | Group Insurance |

|---|---|---|

| Who Buys It | Freelancers, investors, and residents not covered by employer plans | Employers on behalf of their employees |

| Legal Requirement | Mandatory in Dubai and Abu Dhabi for all residents, including self-sponsored visa holders | Mandatory for employers to provide health insurance to employees as per UAE labor law |

| Customization | Relatively high – individuals can choose from various plans within regulatory limits | Limited – employers select the coverage tier; flexibility depends on the company |

| Covers Dependents | Required by law for visa sponsors to insure dependents; benefits vary by plan | In Abu Dhabi, employers must cover one spouse and up to three children; in other emirates, this depends on employer policy |

| Premium Cost | Paid directly by the individual; cost depends on coverage and provider | Typically paid or subsidized by the employer; cost-sharing varies by organization |

| Use Case | Best suited for self-employed professionals, dependents, or residents without employer coverage | Applicable to salaried employees under UAE labor contracts |

| Example | A Dubai-based freelancer selecting maternity and dental benefits | An Abu Dhabi engineer covered under their company’s group policy |

Visa-Linked and Residency-Based Coverage

Health insurance in the UAE is a legal mandate directly tied to your residency and visa status. Whether applying for a new employment visa or renewing an existing one, you are required to submit proof of an active health insurance policy as part of the immigration process.

This requirement is strictly regulated by the Dubai Health Authority (DHA) and the Health Authority Abu Dhabi (HAAD) to ensure that all residents—regardless of employment category—are medically insured and financially protected.

To streamline enforcement, the UAE government has adopted a digitally integrated system that links health insurance coverage directly to your Emirates ID. This eliminates the need for physical insurance cards and simplifies the verification process across medical facilities.

Healthcare providers, including hospitals and clinics, can now instantly verify insurance status via centralized government databases. This cardless infrastructure enables faster claims processing, reduces administrative delays, and ensures seamless access to approved medical services.

Whether you are a salaried employee, sponsored dependent, or long-term expat, compliance with this digital system is essential for uninterrupted healthcare access and legal residency in the UAE.

| Feature | Visa-Linked Coverage | Residency-Based Coverage |

|---|---|---|

| Requirement Trigger | Required for visa issuance or renewal in Dubai and Abu Dhabi; enforcement varies by emirate | Required for legal residents as part of visa or Emirates ID validity |

| Mandated By | Dubai Health Authority (DHA), Department of Health – Abu Dhabi (DOH), and Immigration Authorities | DHA, DOH, and related emirate health regulators |

| Verification Method | Verified during visa processing | Verified via Emirates ID or visa-linked systems |

| ID Integration | Linked to Emirates ID | Linked to Emirates ID |

| Card Needed? | Mostly cardless – Emirates ID is used; some insurers may issue physical cards | Same – access primarily via Emirates ID; physical card optional |

| Primary Use Case | Expat employees or investors under visa sponsorship | Self-sponsored residents, dependents, and non-employed residents |

| Digital Features | May sync with visa records and offer digital access tools | Offers e-claims, health record integration, and Emirates ID-linked validation |

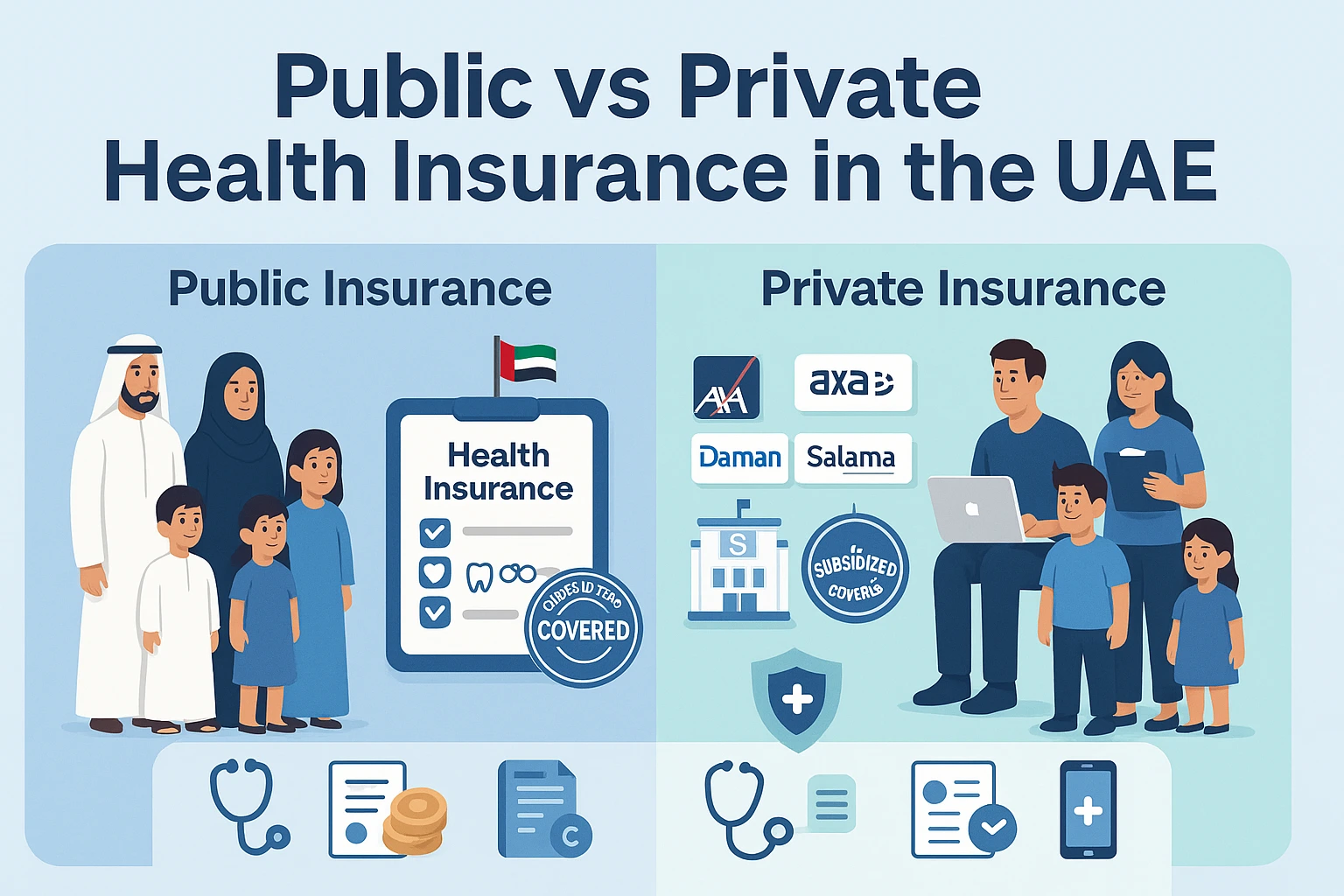

Public and Private Health Insurance in the UAE

In the UAE, health coverage is typically accessed through either public or private systems. These systems ensure that residents receive essential and specialized medical care based on their eligibility, employment status, and insurance preferences.

Public insurance programs, such as Thiqa, are offered by the government to Emirati nationals, primarily in Abu Dhabi. Healthcare services under these programs are delivered through government networks, including SEHA (Abu Dhabi Health Services Company), which manages public hospitals and clinics.

In contrast, private health insurance is widely used by expatriates and private-sector employees. Leading providers—including Daman, AXA, MetLife, Salama, and Orient Insurance—offer various plans that differ in benefits, premiums, and network reach. Residents select insurance types based on residency status, employer sponsorship, budget, and even religious considerations, such as interest in Takaful (Sharia-compliant) insurance.

Government Coverage Programs

The Thiqa Program is a public health insurance initiative offered by the Abu Dhabi government to UAE nationals residing in the emirate. It grants eligible beneficiaries access to a broad network of public and selected private healthcare providers, managed by SEHA.

Thiqa covers a wide range of essential and specialized medical services. It is fully funded by the Abu Dhabi government. Most treatments are provided with minimal or no out-of-pocket costs, subject to policy terms.

SEHA, the government entity for public health management in Abu Dhabi, operates a comprehensive network of hospitals, clinics, and specialty centers. Emirati nationals covered by Thiqa typically receive care at SEHA-managed facilities, which provide services including diagnostics, maternity care, emergency services, and specialist consultations.

The Unified Health Insurance Policy (UHIP) provides basic health coverage for students enrolled in federal institutions, such as UAE University. These student health plans are subsidized by the government or arranged through federal contracts, ensuring students have access to essential healthcare during their academic programs.

On a national level, the UAE government supports its citizens through a variety of publicly funded insurance programs, designed to ensure affordable and equitable healthcare access for all Emiratis.

Private Sector Insurance

In the private sector, major insurers such as Daman, AXA Gulf, MetLife, Salama, and Orient Insurance dominate the UAE health insurance market. While Daman is partially government-owned, it operates independently and offers both Enhanced (private) and Basic (public-linked) health plans.

AXA and MetLife offer globally recognized insurance packages, tailored for individuals, families, and employer-sponsored groups.

For residents seeking Sharia-compliant health coverage, the UAE market provides Takaful plans. These operate on a cooperative model, where members contribute to a pooled fund that pays for eligible healthcare expenses. Takaful plans follow Islamic finance principles, avoiding interest and speculative risk, and are supervised by Sharia boards to ensure compliance.

This model appeals to individuals prioritizing ethical, faith-aligned insurance solutions, offering coverage that aligns with Islamic values.

| Feature | Public Insurance (Thiqa, SEHA, UHIP) | Private Insurance (Daman, AXA, Takaful, etc.) |

|---|---|---|

| Eligibility | Available to UAE nationals (e.g., Thiqa in Abu Dhabi), and select groups such as students in federal institutions (UHIP). | Offered to expatriates, private-sector employees, and self-sponsored residents. Often arranged via employers. |

| Funding Source | Funded by the UAE government through public programs and subsidies. | Paid by employers or individuals, depending on the plan. Some basic policies may be subsidized in select cases. |

| Provider Network | Access to SEHA-managed hospitals and clinics, with limited inclusion of private providers based on program rules. | Wide access to private hospitals and clinics. Tiered networks and global coverage available on premium plans. |

| Flexibility | Generally limited to standardized benefits and fixed networks. Some exceptions apply for specialist referrals. | High flexibility with customizable benefits, add-ons (e.g., dental, maternity), and broader provider access. |

| Shariah Compliance | Not specifically structured as Shariah-compliant. | Takaful options available for Shariah-compliant health coverage, regulated by Sharia supervisory boards. |

| Billing Process | Direct billing through government healthcare systems. Referral services may involve different billing methods. | Both direct billing (in-network) and reimbursement (out-of-network) based on plan structure and provider terms. |

Governing Bodies

The Dubai Health Authority (DHA) oversees all public and private healthcare services in the Emirate of Dubai. It is responsible for licensing healthcare facilities, regulating health insurance policies, and ensuring compliance with the emirate’s insurance laws. DHA requires all Dubai visa holders to be covered by a DHA-compliant health plan, as part of the emirate’s mandatory health insurance framework. To promote equitable access, DHA audits health insurers and enforces baseline coverage standards, ensuring that even basic plans meet essential healthcare needs.

Formerly known as HAAD, the Department of Health Abu Dhabi (DoH) is the primary authority regulating healthcare delivery and insurance in Abu Dhabi. It is responsible for licensing medical professionals and facilities, enforcing employer-sponsored health insurance mandates, and conducting compliance audits on insurance providers. Through its robust regulatory oversight, DoH monitors service quality and insurance coverage to ensure alignment with Abu Dhabi’s healthcare laws and standards.

The Ministry of Health & Prevention (MOHAP) governs federal healthcare policy across the Northern Emirates, including Sharjah, Ajman, Umm Al Quwain, Fujairah, and Ras Al Khaimah. It manages public hospitals, sets national health goals, and coordinates federal health policy with emirate-level implementations. MOHAP also leads major strategic initiatives, including digital health record systems, nationwide vaccination programs, and telemedicine adoption, as part of the UAE’s vision for unified and accessible healthcare.

Mandates & Compliance Systems

ISAHD (Insurance System for Advancing Healthcare in Dubai) is a mandatory health insurance framework introduced by the Dubai Health Authority (DHA) to ensure that all expatriates and their dependents residing in Dubai have valid health insurance coverage. UAE nationals are generally covered under separate public schemes such as Watani.

At the core of ISAHD is the Essential Benefits Plan (EBP), designed to provide affordable, basic healthcare coverage for low-income workers and dependents. Employers and sponsors are legally responsible for providing this insurance, and non-compliance can result in fines, visa processing issues, or penalties through linked systems like EJARI.

The Unified Health Insurance Policy (UHIP) defines the standard structure for private health insurance plans in Abu Dhabi, particularly for expatriates and certain employee groups. Managed by the Department of Health – Abu Dhabi (DoH), UHIP enforces minimum benefit levels and standardized pricing to ensure equitable access to care.

UAE nationals in Abu Dhabi are typically covered under the Thiqa program, not UHIP. UHIP ensures consistent service categorization, insurer transparency, and pricing regulation through approved payer-provider agreements.

Healthcare tariffs in the UAE are governed by regional health authorities: MOHAP (Northern Emirates), DHA (Dubai), and DoH (Abu Dhabi). Each authority publishes regulated service pricing guidelines to promote transparent billing and control medical costs within public and private sectors.

These tariff structures apply primarily to in-network services. Out-of-network treatments may not be subject to the same pricing controls, and patients should verify coverage terms with their insurer to avoid unexpected out-of-pocket costs.

Facility Zones & Access Networks

Dubai Healthcare City (DHCC) is a specialized medical free zone established to position Dubai as a regional hub for healthcare, medical education, and research. It permits 100% foreign ownership, which has attracted a range of global hospital chains, private clinics, and academic medical institutions. DHCC is governed by the Dubai Healthcare City Authority – Regulatory (DHCR), which is responsible for licensing, compliance enforcement, and quality assurance within the zone.

While DHCC operates independently of the Dubai Health Authority (DHA), some health insurers may include DHCC-based facilities within their provider networks, depending on policy agreements. Patients are advised to verify network eligibility before receiving treatment in DHCC to avoid unexpected costs.

In the UAE, health insurance plans define how patients access care based on whether a hospital or clinic is in-network or out-of-network. Network hospitals are healthcare providers that maintain direct agreements with insurers. These agreements typically offer discounted pricing, direct billing, and streamlined pre-approvals for covered services.

By contrast, using an out-of-network provider may lead to higher out-of-pocket expenses, advance payments, or limited reimbursement, depending on your policy. To prevent unexpected charges, patients should always check their insurer’s network list and coverage conditions prior to booking treatment.

To promote ethical healthcare practices and financial accountability, both health insurance providers and regulatory authorities (such as DHA, DoH, and MOHAP) conduct claims audits and utilization reviews. These processes are designed to evaluate the medical necessity, efficiency, and appropriateness of billed treatments.

Utilization reviews help control costs without compromising care quality, while claims audits identify potential issues such as overuse, fraud, or billing anomalies (e.g., duplicate charges or unbundled services). Insurers and healthcare providers must comply with these oversight mechanisms to maintain policy integrity and legal compliance.

| Aspect | Details |

|---|---|

| Dubai Healthcare City (DHCC) | Medical free zone regulated by DHCR. Offers 100% foreign ownership. Hosts hospitals, clinics, and academic medical centers. |

| Regulator | Dubai Healthcare City Authority – Regulatory (DHCR) |

| Network Hospitals | Approved by insurers; offer direct billing, discounted rates, and pre-authorizations. |

| Out-of-Network Coverage | May require upfront payments or partial reimbursement; costs are typically higher and coverage limited. |

| Utilization Reviews | Conducted by insurers to verify medical necessity, reduce overuse, and ensure appropriate care. |

| Claims Audits | Performed by insurers and health authorities (DHA, DoH, MOHAP) to detect billing errors or abuse. |

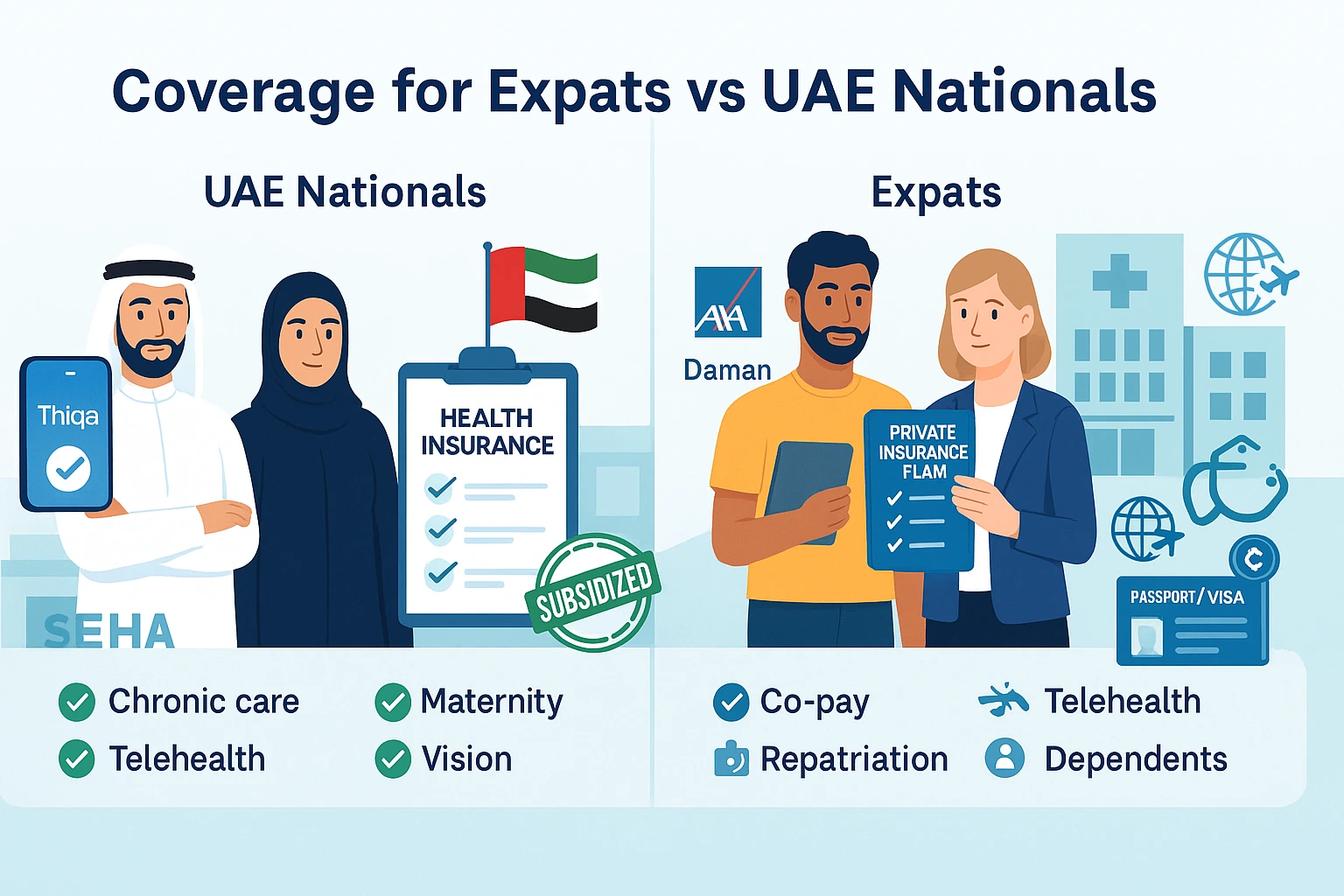

Coverage for Expats vs UAE Nationals

The UAE operates two distinct health insurance ecosystems: one designed for expatriate residents and the other for UAE nationals. Each system is regulated by different authorities and follows unique funding models, access rules, and benefit structures. Employers must provide health insurance for expatriates, or individuals must purchase private plans to meet legal requirements. In contrast, UAE citizens receive government-funded healthcare through federal or emirate-level programs such as Thiqa.

To navigate policy options confidently, residents must understand these differences—particularly when comparing benefit tiers, dependent eligibility, and access to services like chronic condition treatment, preventive care, and emergency support. This section explains how coverage varies between the two groups to help residents make informed and compliant healthcare decisions.

Expat Health Coverage

Expats in the UAE are required to maintain valid health insurance, either through employer-sponsored plans or privately purchased policies. These plans are generally not subsidized by the UAE government, and the cost is typically borne by either the employer or the individual. Lower-tier expat plans may limit or exclude benefits such as maternity care, repatriation coverage, or comprehensive chronic disease management—unless the plan is upgraded to a higher tier.

Expats typically access healthcare through private hospitals and insurer-approved network clinics, as defined in their individual policy. Many professionals—particularly those in high-income or internationally mobile roles—opt for international health insurance plans that include global access and repatriation support. It’s important to note that dependents such as spouses, children, and domestic workers are not automatically included under employer plans and must be insured through separate policies, either by the employer or the individual.

UAE Nationals’ Benefits

UAE nationals, particularly in Abu Dhabi, benefit from government-sponsored health insurance programs such as Thiqa, which is fully funded by the Abu Dhabi government. These national schemes provide comprehensive access to public hospitals and clinics operated by SEHA, MOHAP, and other regional health authorities. Coverage is often family-based, allowing dependents to be included under a unified plan.

In addition to standard care, UAE citizens may be eligible for financial subsidies, preventive health screenings, and access to chronic disease management programs for conditions such as diabetes, hypertension, and cardiovascular illness. In certain cases, government-facilitated repatriation or overseas treatment support may also be available. Most services under these national plans are free at the point of use or heavily subsidized, depending on the level of care and applicable regulations.

| Feature | Expats | UAE Nationals |

|---|---|---|

| Eligibility | All expatriate residents must obtain valid health insurance via employer or personal purchase. | All UAE citizens are automatically eligible for government-sponsored healthcare programs. |

| Funding Source | Funded by employer or the individual. No government subsidies. | Fully or partially subsidized by the UAE federal or emirate government (e.g., Thiqa). |

| Insurance Type | Employer-backed, individual private plans, or international coverage options. | Unified public programs like Thiqa (Abu Dhabi) or other local authority coverage. |

| Dependent Coverage | Not included by default; dependents (spouse, children) require separate policies. | Covered under family-based national plans without separate applications. |

| Access Points | Private hospitals and insurer-approved clinics based on network tiers. | SEHA, MOHAP, and other public healthcare providers with wide access. |

| Chronic Condition Management | May be limited or excluded in low-tier plans; available in enhanced packages. | Included in public healthcare programs with ongoing disease monitoring and support. |

| Repatriation Coverage | Not typically included in basic plans; available in international plans. | Available in certain cases, supported by government healthcare initiatives. |

| Preventive & Wellness Services | Varies by insurer and plan tier; not always included in basic coverage. | Included in national programs such as early screenings, vaccination, and health education. |

Key Services Included in UAE Health Insurance

Health insurance in the UAE is structured by both federal and emirate-level authorities to guarantee access to essential, preventive, and specialized medical care—for residents, expatriates, and UAE nationals alike. While the extent of coverage may differ depending on the policy tier, insurer, and emirate, all UAE-compliant plans include standardized categories of healthcare services.

These standard benefits typically cover inpatient and outpatient treatments, chronic disease management, maternity care, telemedicine, and digital health portals connected to the Emirates ID system. In this section, we outline the core service categories included in compliant UAE health plans and explain how coverage levels vary across the mandatory, enhanced, and top-up benefit tiers.

Essential Health Benefits

All UAE-compliant health insurance plans—whether for expats or nationals—must include a core set of services known as Essential Health Benefits. These are legally mandated by authorities such as the Dubai Health Authority (DHA), Department of Health Abu Dhabi (DoH), and MOHAP, and form the foundation of every Essential Benefit Plan (EBP) issued across the country.

Inpatient services—which include surgeries, diagnostic procedures, and overnight hospital stays—are fully covered, with costs often borne entirely by the insurer. Similarly, outpatient services such as general practitioner consultations, diagnostics, and specialist care are included, though these may require co-payments ranging between 10–20%, depending on the plan tier.

Emergency care coverage is a legal requirement and applies regardless of network affiliation. This includes 24/7 access to stabilization units, ER visits, and ambulance services within city limits. Coverage must be provided without delay in life-threatening scenarios.

For women, maternity care is a mandatory inclusion in all eligible plans, providing access to prenatal checkups, laboratory tests, ultrasounds, delivery (including C-section), and postnatal care. Limits and caps may vary by provider, but the benefit itself cannot be excluded. Newborns are also entitled to screening and immunizations, following national health schedules to detect congenital and metabolic conditions early.

Preventive care is another essential benefit, with mandatory vaccination programs for children and adults enforced under DHA and MOHAP guidelines. These include routine immunizations and seasonal shots like the influenza vaccine.

| Benefit | Basic Plan (EBP) | Enhanced/Comprehensive Plan |

|---|---|---|

| Inpatient Care | Covered with pre-approval; shared rooms only | Covered; includes private room options and extended services |

| Outpatient Visits | GP and specialist visits covered; 10–20% co-payment may apply | Wider access to specialists with reduced or waived co-pays |

| Emergency Services | 24/7 emergency access including ambulance within city limits | Same as basic; may include international emergency support |

| Maternity Coverage | Included with limits; prenatal and delivery (e.g., C-section) | Higher annual limits, advanced scans, private delivery options |

| Newborn & Vaccinations | Covers newborn screening and mandatory immunizations | Same as basic; may also cover elective vaccines and pediatric wellness |

| Preventive Checkups | Limited; depends on plan design | Often includes annual health screenings and lifestyle assessments |

Chronic & Long-Term Care

Most UAE-compliant health insurance plans include coverage for chronic disease management, especially for high-prevalence conditions like diabetes and renal disorders. These services typically cover regular medication, diagnostic tests, and routine follow-ups, and are mandated by regulatory bodies such as DHA, DoH, and MOHAP to ensure continuity of care for long-term conditions.

In basic health plans, chronic care is usually limited to essential treatments like routine blood sugar monitoring, insulin provision, or basic renal checkups. In contrast, enhanced or employer-sponsored policies provide more comprehensive care—such as specialist consultations, ongoing endocrinology or nephrology support, and access to additional therapies as needed.

For patients recovering from surgery, stroke, or trauma, rehabilitation services may be covered under select plans—especially those that meet medical necessity criteria. This can include physiotherapy, speech therapy, and occupational rehabilitation, but typically requires pre-authorization from both a treating physician and the insurer’s utilization review team.

Services like long-term nursing care or in-home healthcare (e.g., daily assistance, wound care, or mobility support) are generally excluded from basic plans due to cost and duration. However, they may be available in enhanced or top-up plans. As a rule, insurers will require specialist documentation and proof of clinical necessity before approving these extended services.

| Service | Basic Plan (EBP) | Enhanced/Employer Plans |

|---|---|---|

| Diabetes Management | Covers routine medication, glucose tests, and basic follow-ups | Includes specialist visits, dietary consultations, and extended monitoring |

| Renal Care | Includes basic monitoring and essential lab work | May include dialysis, specialist nephrology care, and home visits (with approval) |

| Rehabilitation (Post-Stroke/Surgery) | Limited or excluded unless deemed medically necessary | Covers physiotherapy, occupational therapy, and extended rehab sessions |

| Long-Term Nursing Care | Generally excluded | Available in select plans with specialist approval and pre-authorization |

| Home Healthcare | Not included | Optional or top-up benefit in custom or VIP plans |

| Medical Necessity Review | Required for advanced care; insurer may deny high-cost claims | Mandatory for long-term services; reviewed by specialists and insurer’s medical team |

Specialized & Digital Health Services

Modern health insurance plans in the UAE have evolved to include digital-first healthcare services that improve convenience, transparency, and accessibility for both expats and nationals. These services are regulated by DHA, DoH, and MOHAP, and are now considered essential across both basic and enhanced plan tiers.

Telemedicine—which saw rapid expansion during COVID-19—is now a standard feature in most UAE-compliant plans. Patients can consult licensed physicians via video or app-based platforms for non-emergency issues, follow-ups, or prescription refills. This not only reduces waiting times and clinic visits but also lowers consultation costs.

Most private insurers and government authorities offer mobile health apps and e-claims portals, enabling users to schedule appointments, view policy details, upload documents, and request reimbursements—all digitally. These platforms also support pre-approval submissions and real-time claim tracking, minimizing paperwork and delays.

A standout innovation in UAE healthcare is the integration of Emirates ID with insurance policies. Instead of presenting a physical insurance card, patients can use their Emirates ID at hospitals, pharmacies, and clinics to instantly verify eligibility, access approved services, and streamline billing.

Pharmaceutical and laboratory services are included in both basic and enhanced plans. While basic plans typically cover generic medications and routine diagnostics, enhanced plans offer wider access to branded drugs, chronic disease medications, and advanced diagnostic tools—often with faster approvals and direct specialist referrals.

Digital health in the UAE is not just a convenience—it’s becoming a regulatory standard, helping the nation move toward paperless, interoperable, and patient-centered care.

Comparison: Digital & Specialized Services in UAE Health Plans

This table highlights the differences in digital healthcare access, pharmacy support, and diagnostics between basic and enhanced insurance policies in the UAE.

| Service | Basic Plan (EBP) | Enhanced/Comprehensive Plan |

|---|---|---|

| Telemedicine Access | Available for general consultations via licensed platforms | Includes teleconsultations with specialists, faster booking, and follow-ups |

| Mobile Health Apps | Insurer app access for policy and appointment info | Enhanced features such as symptom checks, chatbots, health monitoring |

| E-Claims Portal | Supports reimbursement requests and pre-approvals | Real-time tracking, multi-claim uploads, and faster processing |

| Emirates ID Integration | Linked to insurance for clinic and pharmacy access | Same functionality with enhanced fraud prevention and network syncing |

| Pharmacy Benefits | Covers generic drugs and acute treatments | Includes branded medications, chronic prescriptions, and home delivery (in select plans) |

| Lab & Diagnostic Tests | Basic diagnostics and blood tests with possible pre-approval | Broader diagnostic panel, faster approvals, and direct specialist referrals |

Optional & Enhanced Benefits in UAE Health Insurance

While basic UAE-compliant health plans focus on essential coverage, enhanced and corporate insurance packages often include a variety of additional benefits tailored for broader healthcare needs and lifestyle support. These may include dental, vision, fertility care, physiotherapy, cancer support, and even in-home services—subject to plan type, provider policy, and medical necessity.

Dental and vision care are generally excluded from basic plans but may be available as optional add-ons or standard features in enhanced coverage. These typically cover routine cleanings, X-rays, fillings, eye exams, and corrective lenses, especially in family or employer-sponsored group plans.

Radiology services like X-rays, MRIs, and CT scans are included in all compliant plans but often require pre-authorization to ensure medical necessity and cost control. Similarly, physiotherapy is covered under enhanced policies, with basic plans offering only a limited number of sessions per year (e.g., 6–12), often requiring a referral.

Cancer treatment is considered an essential health benefit and must be covered under all UAE-compliant plans when medically necessary. However, referral pathways, prior approval, and co-payment percentages may vary depending on the plan’s tier and insurer.

Fertility treatments, such as IVF or ICSI, are rarely included in standard coverage but may be offered in high-tier enhanced plans or through self-funded packages. DHA and DoH regulate fertility-related coverage under strict eligibility and clinical protocols.

Finally, home healthcare services—such as in-home nursing, wound care, or rehabilitative support—are typically reserved for VIP or executive plans. These require documentation from a licensed physician and pre-approval by the insurer.

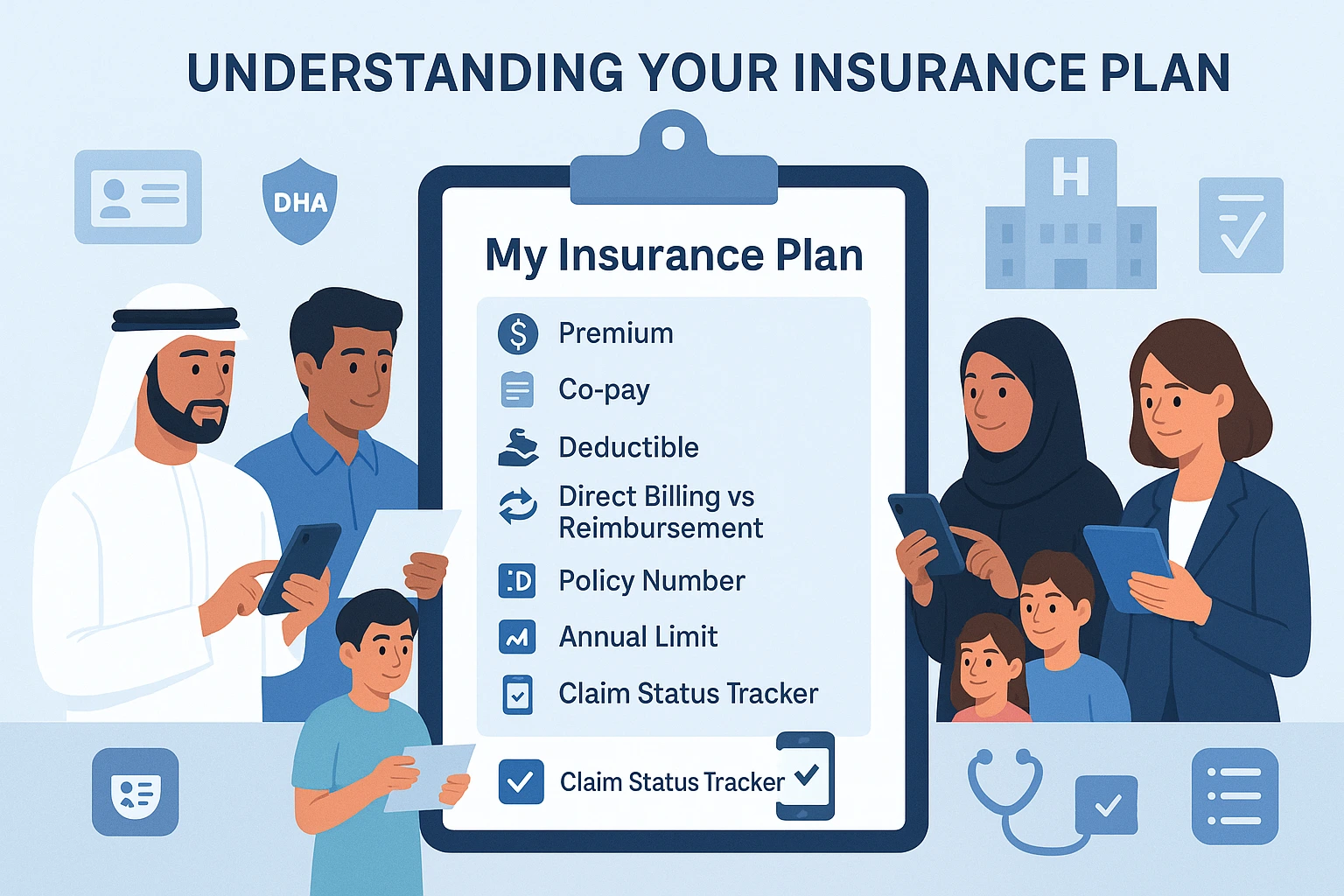

Understanding Your Insurance Plan

Whether you’re new to the UAE or reviewing your current policy, understanding the mechanics of your health insurance plan is essential for making informed healthcare decisions. From premiums and co-pays to claim cycles, network access, and the role of intermediaries, every plan comes with its own rules, restrictions, and benefits. This section breaks down the key components of UAE health insurance plans—helping you navigate coverage limits, hospital networks, authorization requirements, and the difference between direct billing and reimbursements. Whether you’re an employee, sponsor, or self-insured resident, this guide will help you get the most from your policy while staying compliant with national regulations.

Key Plan Mechanics

At the core of every UAE health insurance plan lies a set of financial and operational principles that determine how your policy functions—both during enrollment and when accessing care.

Premiums are the fixed payments made to maintain your insurance coverage. These can be paid monthly or annually and may be covered by an employer (in group policies) or directly by individuals. Premiums vary based on factors such as plan tier, age, medical risk, and coverage scope. While insurers set their own premium rates for enhanced plans, regulators like the Dubai Health Authority (DHA) and Department of Health – Abu Dhabi (DoH) enforce minimum benefit requirements and ensure pricing fairness in basic plans.

A co-payment (co-pay) is the portion of medical costs paid by the policyholder at the point of care. Under standard plans such as DHA’s Essential Benefits Plan (EBP), co-pays typically range between 10% and 20% for outpatient services, medications, or diagnostics. Enhanced plans may offer lower co-pays or waive them at select providers, depending on network arrangements.

Deductibles, which represent an upfront amount paid before insurance coverage kicks in, are generally not included in mandatory basic plans like EBP or UHIP. However, deductibles may apply in international or high-tier executive insurance plans.

Most UAE insurers operate on a direct billing model within their approved provider networks. This means the healthcare provider bills the insurer directly, and the patient pays only applicable co-pays or uncovered services. For treatment at out-of-network clinics or overseas facilities, a reimbursement model may be used. In this case, patients pay upfront and later submit a claim with receipts, a medical report, and a completed claim form. Claim processing timelines are regulated, with 15 to 30 working days allowed depending on the case and regulatory authority.

Your annual coverage limit is the maximum amount your insurer will pay in a policy year. For example, the DHA mandates a minimum of AED 150,000 in annual coverage under the Essential Benefits Plan. Higher-tier plans often come with increased coverage ceilings, including international benefits.

Every policy is identified by a unique policy number, which is used by insurers to track your claim history, approvals, and policy entitlements. While healthcare providers maintain your medical records, insurers must submit all claims through e-claims platforms mandated by DHA, DoH, and MOHAP. These platforms ensure real-time tracking of claims and compliance with regulatory timelines, promoting transparency in claim processing and payment cycles.

Provider Networks & Verification

Health insurance in the UAE is delivered through insurer-managed provider networks, which vary in size and service level. Depending on your plan type—whether basic, standard, or enhanced—your policy will grant access to specific hospitals, clinics, and diagnostics centers with differing coverage terms and co-payment structures.

If you visit an in-network provider, your insurer typically offers direct billing, meaning the clinic bills the insurance company directly and you are responsible only for applicable co-pays or excluded services. In contrast, for out-of-network care, you will often need to pay upfront and submit a reimbursement claim. Approval is subject to the insurer’s policies and may require pre-authorization, especially for high-cost or non-urgent procedures.

In plans like Dubai’s Essential Benefits Plan (EBP) or Abu Dhabi’s UHIP, a referral from a general practitioner (GP) is usually required before consulting a specialist. This GP-to-specialist referral pathway is intended to promote continuity of care and reduce unnecessary specialist visits.

Before treatment, most UAE healthcare facilities perform real-time eligibility checks using your Emirates ID, which is digitally linked to your insurance policy. This process instantly verifies your network access, plan status, and whether a pre-approval is required.

For procedures such as advanced imaging, surgeries, or non-emergency treatments, insurers typically require pre-authorization. This involves uploading relevant documents (e.g., medical reports) via the insurer’s digital portal. Failure to secure pre-approval, when required, may lead to claim rejection or full out-of-pocket charges.

Regulatory bodies including the Dubai Health Authority (DHA), Department of Health – Abu Dhabi (DoH), and Ministry of Health & Prevention (MOHAP) ensure that network access, billing practices, and verification processes meet national health standards—safeguarding both patient care and insurer accountability.

Role of Intermediaries

In the UAE, insurance intermediaries—including brokers and agents—play a vital role in helping individuals and businesses choose and manage their health insurance plans. Regulated by the Central Bank of the UAE (CBUAE), these professionals act as facilitators between policyholders and insurers, particularly for selecting the right coverage and navigating claims.

Brokers operate independently and are authorized to compare multiple plans across different insurers. They represent the policyholder’s interests. Agents, on the other hand, are tied to a specific insurer and focus on selling that company’s products. Intermediaries involved in health insurance may also need to register with the DHA or DoH to operate in Dubai or Abu Dhabi, respectively.

When applying for certain policies—especially enhanced, international, or executive plans—insurers may conduct medical underwriting. This assesses health risks based on your history and may influence your premium, impose waiting periods, or exclude specific conditions. However, mandatory basic health plans like DHA’s Essential Benefits Plan (EBP) or DoH’s UHIP are not subject to medical underwriting and must be offered regardless of pre-existing conditions.

All insurance plans include policy exclusions, which outline what is not covered—such as cosmetic surgery, fertility treatments, elective dental care, or pre-existing conditions under limited plans. These exclusions must be clearly disclosed and acknowledged before a policy is issued, as required by UAE regulations.

If you experience a claim denial, billing error, or other issue, most insurers offer an internal complaint system. If unresolved, you can escalate the case to the appropriate regulatory authority:

- DHA (Dubai) via the iPROMeS system

- DoH (Abu Dhabi) via Istijaba

- MOHAP (Northern Emirates)

These bodies ensure fair resolution and protect consumer rights under UAE law.

Whether you’re purchasing a plan, submitting a claim, or challenging a denial, licensed intermediaries can support with documentation, communication, and appeal filing. However, they must operate transparently, disclose commissions, and avoid giving unauthorized medical advice.

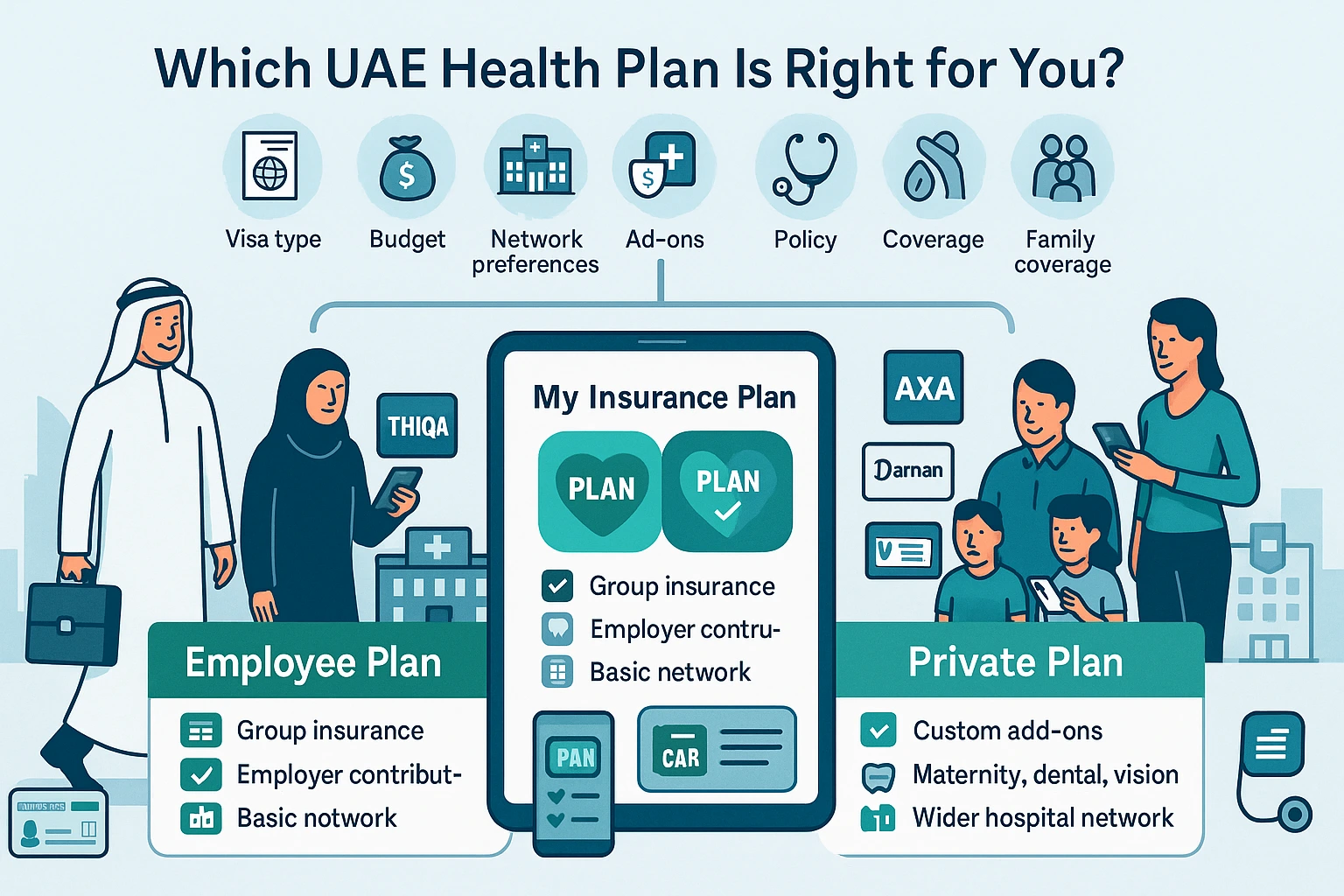

Choosing the Right Health Insurance Plan in the UAE

With dozens of insurers and plan types available across the UAE, choosing the right health insurance plan can feel overwhelming—especially given the differences based on residency status, visa sponsorship, employment type, and emirate-specific regulations. Whether you’re a salaried employee, business owner, freelancer, or dependent, the right plan should not only fit your budget but also comply with local health insurance mandates set by authorities such as the Dubai Health Authority (DHA), Department of Health – Abu Dhabi (DoH), or the Ministry of Health & Prevention (MOHAP) for Northern Emirates.

This section guides you through the essential decision-making criteria—including plan tiers, provider networks, co-pays, pre-approvals, and exclusions. It also offers insights into leading insurance providers and how to read the fine print—so you can select a plan that is not just affordable but also reliable, compliant, and responsive when it matters most.

How to Choose the Right Health Insurance Plan in the UAE (Based on Your Status and Needs)

Choosing the right health insurance plan in the UAE begins with understanding your residency status, visa category, and the emirate in which you reside—as these factors directly affect your legal obligations, coverage options, and eligibility criteria.

For example, UAE nationals may be eligible for government-funded healthcare programs such as Thiqa (for Abu Dhabi residents) or access to MOHAP-managed public health facilities in the Northern Emirates. In contrast, expatriate residents must secure private health insurance that meets the regulatory standards of the Dubai Health Authority (DHA), Department of Health – Abu Dhabi (DoH), or Ministry of Health & Prevention (MOHAP)—depending on their emirate of residence.

Your visa type also plays a major role. If you are on an employment visa, your employer is legally required to provide a compliant health insurance plan. However, if you are a freelancer, investor, dependent, retiree, or golden visa holder on a self-sponsored visa, you are responsible for arranging and maintaining your own private insurance. This coverage must meet the minimum benefits mandated by UAE health authorities, or you risk complications during visa issuance, renewal, or cancellation.

What to Look for When Comparing Health Insurance Plans in the UAE?

Below are key decision factors to consider when choosing a health insurance plan based on UAE residency and regulatory compliance.

| Criteria | What to Look For | Why It Matters? |

|---|---|---|

| Network Coverage | Check if the plan includes hospitals and clinics near your home or workplace. Confirm direct billing availability at in-network facilities. |

In UAE, insurers operate within approved provider networks. Using in-network services ensures lower co-pays and smooth claims processing under DHA, DoH, or MOHAP guidelines. |

| Co-Payments & Out-of-Pocket Costs | Understand how much you’ll pay for GP visits, lab tests, prescriptions, or specialist care. Compare co-pay rates (often 10%–20%) and policy caps. |

Co-pay structures are regulated (e.g., DHA caps for Basic Plans). Budgeting for co-pays helps avoid unexpected expenses during treatment. |

| Optional Add-Ons | Evaluate the need for add-ons like dental, vision, maternity, or international travel coverage. Choose only those relevant to your lifestyle or family needs. |

Add-ons are optional and not included in mandated basic plans (e.g., EBP or UHIP). Enhance your coverage legally while aligning with your personal health requirements. |

| Waiting Periods | Review if waiting periods apply to maternity, chronic illnesses, or pre-existing conditions. Check how long before certain benefits become active. |

Insurers may legally impose waiting periods on specific services. Being informed helps manage expectations and coverage timelines. |

| Policy Exclusions | Look for a list of services not covered—commonly cosmetic surgery, fertility treatments, or elective procedures. Ensure exclusions are clearly disclosed before purchase. |

UAE law mandates transparency in exclusions. Knowing what’s excluded helps prevent claim denials and supports informed decision-making. |

Comparing UAE’s Top Health Insurance Providers: Daman, SEHA, AXA & Salama

| Provider | What They Offer | Best For |

|---|---|---|

| Daman Semi-government insurer |

Official provider for Abu Dhabi’s Thiqa and Basic Plans. Strong national network, SEHA integration, and Emirates ID-linked digital services. | UAE nationals in Abu Dhabi, salaried employees under DoH-regulated plans |

| SEHA Public healthcare network |

Operates government hospitals and clinics in Abu Dhabi. Not an insurer but key provider under Thiqa and Daman policies. | UAE nationals and public-sector employees in Abu Dhabi |

| AXA (GIG Gulf) Private global insurer |

Offers international coverage, VIP-tier plans, and strong expat support with telehealth and multilingual customer service. | Expats, business travelers, multinationals |

| Salama Shariah-compliant (Takaful) |

Ethical, cooperative health insurance aligned with Islamic values. Online portals and standard add-on options. | Policyholders seeking Shariah-compliant coverage |

FAQs on UAE Health Insurance

Yes, pre-existing conditions are covered after a waiting period, usually between 6 months to 1 year, depending on the plan. Enhanced plans may reduce or waive this period with medical underwriting.

Dr. Aisha Rahman is a board-certified internal medicine specialist with over 12 years of clinical experience in chronic disease management and preventive healthcare. She has worked at leading hospitals across the UAE, helping patients manage conditions such as diabetes, hypertension, cardiovascular diseases, and metabolic disorders.

A strong advocate for preventive medicine, Dr. Rahman emphasizes early diagnosis, lifestyle modifications, and patient education to reduce chronic illness risks. She is an active member of the Emirates Medical Association and has contributed to health awareness programs and medical research initiatives. Her expertise has been featured in The National UAE, Gulf Health Magazine, and leading medical journals. As a keynote speaker at healthcare conferences, she shares insights on evidence-based treatments, patient-centered care, and advancements in internal medicine.

Very nice article. Well researched and defined. Great job 🙂